Tier II Filing Fee Timing by Jurisdiction

Tier II filing fees can be assessed by states, LEPCs, and fire departments.

The timing of when those fees are assessed can also vary by jurisdiction. While most fees, particularly at the state level, are paid at the time of report submission, many local jurisdictions issue invoices weeks or months after the report has been submitted.

This article will break down whether and when you can expect to pay a filing fee for a given state or local jurisdiction.

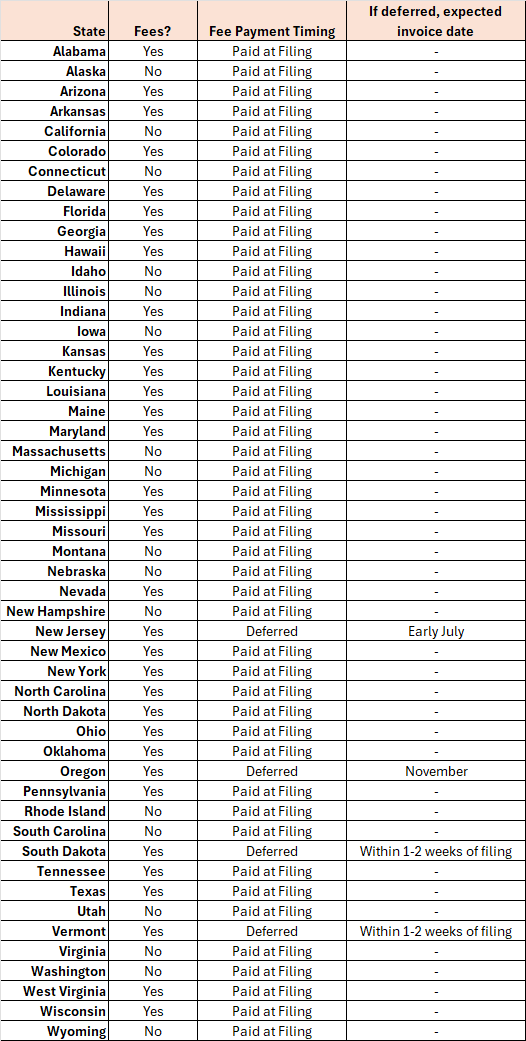

State Fees

The State Fees table contains the following columns:

Fees: Indicates whether the state charges fees (Yes or No).

Fee Payment Timing: Shows when fees are paid, which is "Paid at Filing" for most states. "Deferred" means invoices are generated and sent a period of time after the report is filed.

If deferred, expected invoice date: Provides the expected invoice date for states with deferred fee payments.

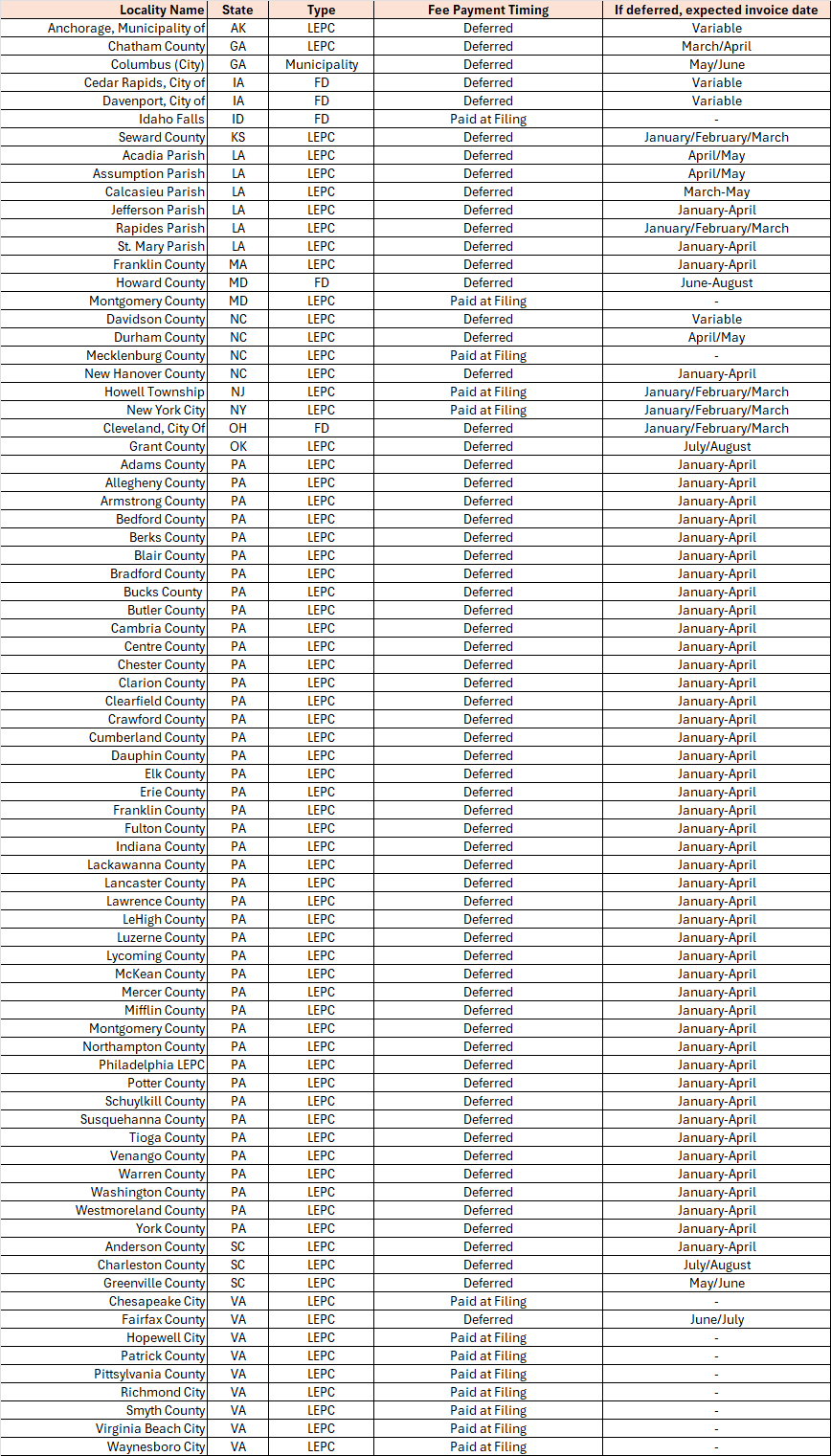

Local Fees

The Local Fees table includes the following columns:

Locality Name: Lists various local jurisdictions, primarily counties and cities.

State: Indicates the state in which the locality is located.

Type: Specifies the type of local entity (e.g., LEPC, FD, City).

Fee Payment Timing: Shows when fees are paid, either "Paid at filing" or "Deferred".

If deferred, expected invoice date: Provides the expected invoice date range for localities with deferred fee payments.

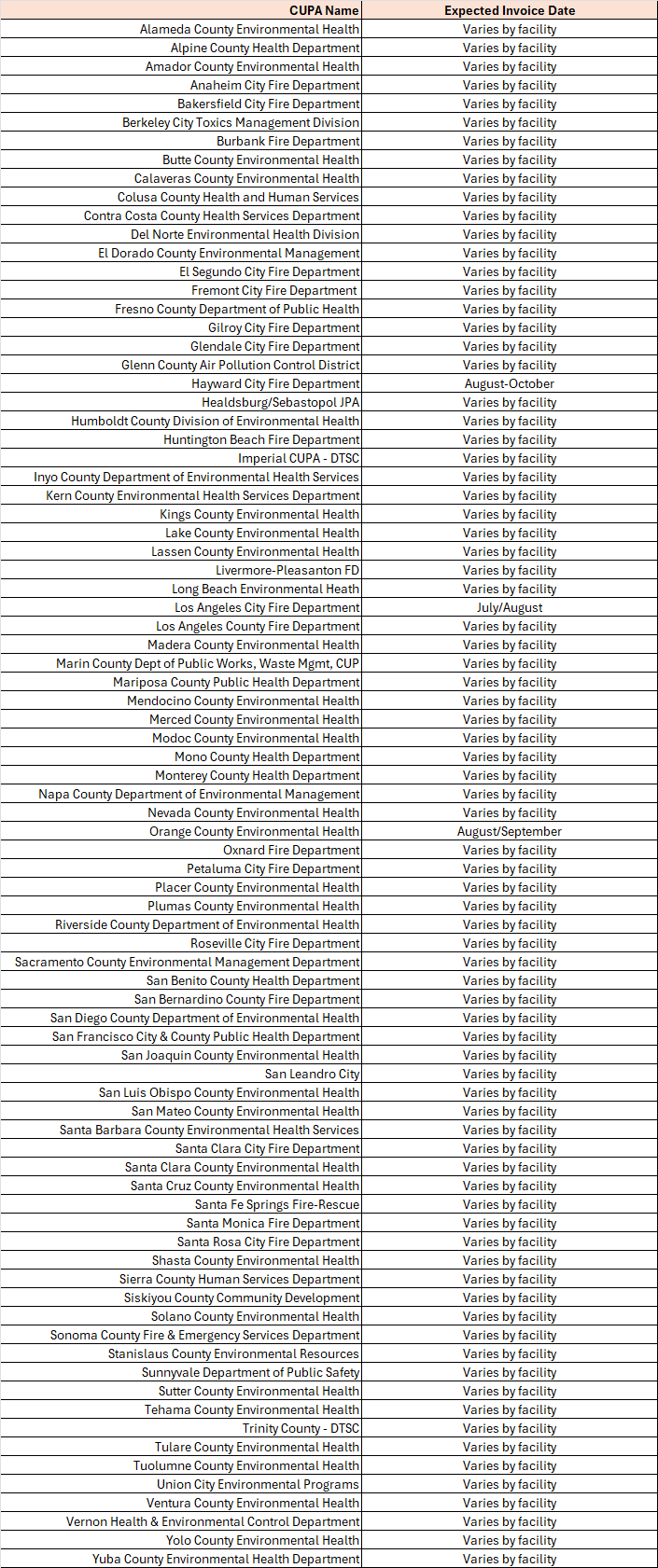

California Fees

The California Fees table includes the following columns:

CUPA Name: Lists various Certified Unified Program Agencies (CUPAs) in California, which are similar to Local Emergency Planning Committees.

Expected Invoice Date: Indicates when invoices are expected to be issued. For most CUPAs, the invoice varies based on when the most recent Hazardous Materials Business Plan was submitted, as well as when the CUPA may have performed the most recent facility inspection.